Natural gas covers about a quarter of Austria's total energy demand. 80 percent of it comes from Russia. Industrial companies with high gas requirements can hardly do without this energy source. So what happens if Russia really does turn off the gas tap completely? And what is the current gas supply situation in Austria?

Current gas situation in Austria

Austria consumes almost 90 terawatt hours (TWh) of natural gas annually. About ten percent of this quantity is covered by domestic production. This gas is produced by

OMV and

RAG Austria. The rest is imported, up to 80 % from Russia until 2022. Whether the Russian import share has actually been reduced to 50 % in the meantime or

has even increased is currently a matter of disagreement in Austria.

Emergency plan primarily affects companies

If Russian gas supplies are cut off as a reaction to the Western sanctions, the state can take

energy reduction measures so that households and social institutions such as hospitals, old people's homes and kindergartens can be supplied preferentially. Systemically important consumers such as the food industry, fuel industry, timber industry or power generation plants may also be exempted.

The downside of the emergency plan: For industry and commerce it will be much tighter than it already is. If there is a complete gas shortage, 35 large Austrian industrial companies with high gas consumption would have to restrict their production. If this is not enough, another 7,500 companies whose gas consumption exceeds 400,000 kilowatt hours per year will be added to the list.

How drastic the measures could become depends above all on the filling level of the gas storage facilities and the extent to which gas can be procured from countries other than Russia.

Gas storage facilities are increasingly filling up

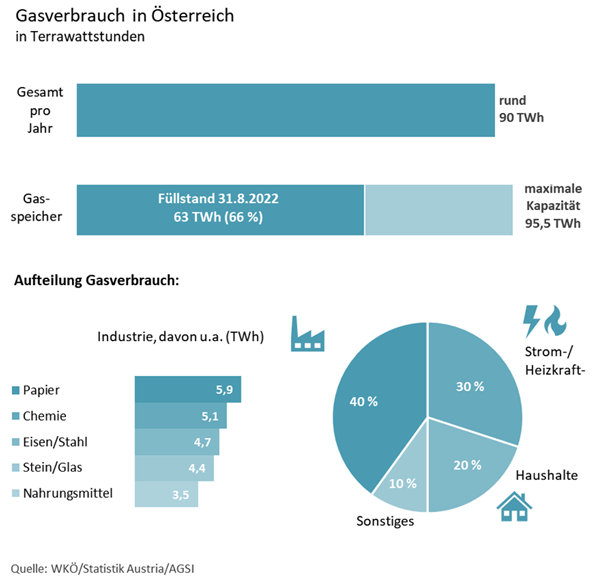

Austria's gas storage facilities are now filled with 63 TWh of natural gas - this corresponds to a filling level of 66 percent (31.8.2022,

for current filling levels see AGSI+). OMV's storage facilities are 91 percent full. The storage volume thus corresponds to almost three quarters of the annual consumption in Austria. However, only the strategic reserve of 20 TWh is fully accessible.

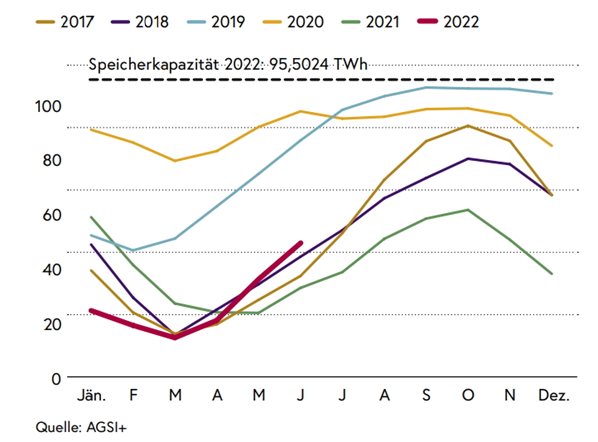

The graph shows the filling levels over the course of the year in the period 2017 to 2022. The year 2020 is not representative due to the pandemic and the lower gas consumption. The low storage volumes in the second half of 2021 are a consequence of the sharp increase in wholesale gas prices since mid-2021. The outbreak of the Ukraine war in the first quarter of 2022 has exacerbated the situation (source:

Energy in Austria 2022, AGSI+).

The fairy tale of high gas consumption by private households

Household energy consumption does not play as important a role as generally assumed. In recent years, the share of gas in private energy supply has fallen to below 20 % of the energy mix.

.png.aspx?width=599&height=307)

Another 10% is used for transport, services and other. 30% of the total gas demand is used in the conversion sector for electricity and district heating generation and serves primarily to stabilise the electricity grid (power plants, CHP plants, district heating plants).

The main share of natural gas, around 40%, goes to the manufacturing industry, as a raw material or for the generation of process heat - and this also in summer. Industry in Austria is therefore highly dependent on natural gas. The steel, paper, glass and chemical industries in particular require large quantities.

In 2020, final energy consumption in paper and printing was 5.9 TWh of gas, in chemicals and petrochemicals it was 5.1 TWh. This corresponds to 19.3 and 16.7 percent of total gas consumption in the manufacturing sector. This is followed by iron and steel production with 4.7 TWh of gas, the ceramics industry (stones and earths, glass) with 4.4 TWh and the food industry with 3.5 TWh.

The inconvenient truth: There is no short-term alternative to natural gas

Austria's dependence on gas imports has grown over decades and, due to a lack of infrastructure, cannot be changed in the short term with biogas, LNG liquid gas, hydrogen or alternative energies. A switch to coal or oil is also only possible to a limited extent.

The Austrian economy cannot be sustained without natural gas. Especially in the manufacturing industry, natural gas is currently without alternative. If the continuous supply of gas is interrupted, production must be limited or - where this is not possible - shut down. Such shutdowns of large plants take weeks and are very cost-intensive. In addition, there are production bottlenecks in downstream industries due to the complexity of the value chains.

Shutting down industry is just not that simple, not to mention the damage to production plants in the event of a total failure of the gas supply. In the steel industry, in the manufacture of glass and in foundries, a gas stoppage would lead to a complete breakdown of the melting processes and cause irreparable damage to production facilities costing millions.

Likewise, the production of pharmaceutical products would come to a standstill. In

semiconductor production and in the manufacture of hygiene products and packaging, irreparable damage to the plants would be the result, making it impossible to restart them in a short time.

Food and fertiliser industry: 70 % less fertiliser

Natural gas is needed in all areas of food production, as many production steps are very energy-intensive or require very high temperatures. Hardly any producer of food, animal feed or beverages can currently manage without this fossil fuel.

For example, gas powers grain and oil mills and is needed to maintain cold chains, e.g. for dairy products. A gas supply stop would endanger the security of supply in Austria. If no gas comes out of the pipeline, food production comes to a standstill.

But even without a gas freeze, the situation in the food sector is already extremely tense.

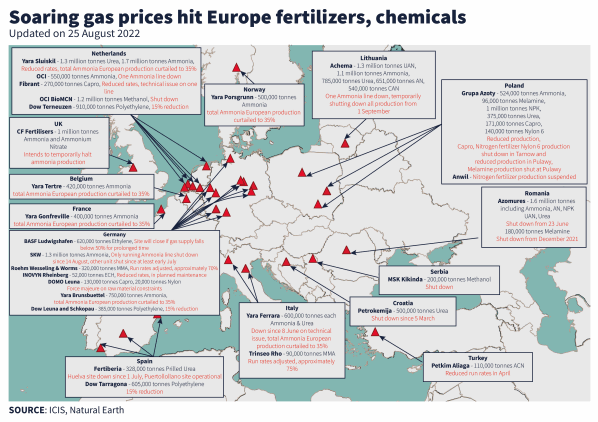

The high natural gas prices have driven up the prices for nitrogen products such as fertilisers and have meanwhile led to the closure of many ammonia or fertiliser factories in Europe. 70% of production capacity has already been eliminated. Lithuania's largest fertiliser plant, Achema, recently had to suspend operations.

CEO Ramūnas Miliauskas commented on the closure as follows:

"In the current market situation, most Western fertiliser producers are forced to close their factories, and Achema is no exception. Record natural gas prices are directly affecting production costs, and our fertiliser prices are no longer competitive with the production of US and Russian manufacturers."

With the loss of fertiliser production, not only are prices going through the roof, but food production is also coming under increasing pressure. The effects this can have are shown by the example of

Sri Lanka. The ban on the use of artificial fertiliser has caused the country's food production to collapse in just one season.

The following

ICIS Twitter graphic illustrates the extent of the closed factories very clearly.

Glass industry: Easily breakable without gas

The glass industry is also dependent on natural gas - and to a particularly high degree. Glass is melted in large melting tanks at constant temperatures of up to 1,600 °C so that it can then be processed. There is no provision for shutting down the production plant in between - the molten glass would solidify and damage the tanks, in the worst case rendering them unusable.

With costs of 15 to 20 million euros per tank, even a short-term failure of the gas supply would have catastrophic consequences. It would take several months to procure replacements and restart production. A short-term switch to other energy sources is not possible in the event of a gas supply failure. Several months of preparation are needed for this.

However, the explosion in costs makes it increasingly difficult to operate the furnaces economically and is already proving to be a threat to the existence of some companies.

Glass products have an enormous importance for many areas of our everyday life and economy: from hollow glass for food and cosmetic products to window glass and special glass for technology and science to mineral fibres from which glass and rock wool are produced for thermal insulation.

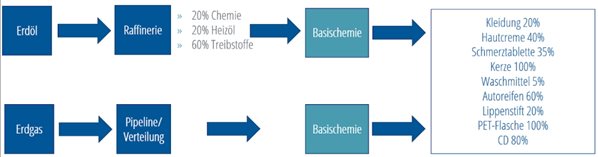

Chemical industry: The heart of the economy

For the chemical industry, natural gas is of central importance as a raw material and energy source. Nothing runs without gas and oil, and the economy does not run without the chemical industry. The industry not only produces systemically important products such as medicines, disinfectants or fertilisers, but also supplies precursors for 96 percent of all goods manufactured in the EU.

Source: VCI

In the short term, natural gas can hardly be replaced in the chemical industry. In recent years, energy consumption has already been significantly reduced in the course of the

decarbonisation of the chemical industry and many places have converted to sustainable technologies for energy production. Donauchem also produces its own electricity at its sites in Lower Austria and Carinthia and only relies on gas in certain areas.

However, replacing natural gas is difficult in areas where it is processed as a raw material in chemical processes. In the future,

biogas and

hydrogen could replace gas, but neither is yet available in sufficient quantities.

An abrupt stop of the gas supply would have catastrophic effects on the supply of vital goods.

Hubert Culik, Chairman of the FCIO

Even a reduction in the supply of natural gas to less than 50% of normal demand would lead to a complete cessation of production activities in many chemical companies. This would not only cause bottlenecks in energy-intensive products such as electrolysis and nitrogen products or

sulphuric acid. Countless downstream industries would also be affected by

considerable production bottlenecks: Agriculture, food, automotive, cosmetics and hygiene, construction, energy, pharmaceuticals or electronics - to name just a few.

Paper industry: No gas, no toilet paper

Austria is considered a "paper country". The 23 domestic paper and pulp mills produce five million tonnes of paper and two million tonnes of pulp per year. Gas is needed in paper mills for steam and electricity generation, and in pulp mills as start-up and back-up fuel. That the paper industry needs so much gas is mainly because the paper pulp has to be dried, often with heat generated from gas.

In the short term, it is not technologically possible to replace gas with another fuel. If there is a shortage of gas or if gas prices are too high, parts of production could initially be shut down, as is

likely to be the case soon at Lenzing AG's Heiligenkreuz site in southern Burgenland. But if the gas supply comes to a complete standstill, all paper mills would have to be shut down. An emergency plan to switch to oil was again discarded. The quantities of oil required, i.e. one tanker every two hours, are logistically not feasible.

© Austropapier

A production stoppage would have far-reaching consequences. Numerous products would no longer be available within a very short time.

- Packaging for basic foodstuffs such as pasta, rice, flour, salt, bread, eggs, milk and many more.

- Repackaging of medicines and pharmaceuticals.

- Packaging for parcel services.

- Hygiene papers made of paper or pulp for medical care or household use (nappies, toilet paper → German paper industry warns of bottleneck).

- Speciality papers for industrial processes (e.g. for use in painting vehicle bodies).

- Books, newspapers and magazines.

In addition, the paper mills use the self-generated energy to supply buildings in the surrounding area with 271 GWh of electricity and 2,000 GWh of district heating in addition to their own production. This decoupled energy corresponds to the electricity and heat needs of 100,000 households.

Steel industry: bread before steel?

In steel production, gas is used as a fuel to generate high temperatures. In addition, like pig iron, it is used as a reducing agent in various process steps. A switch from natural gas to oil or coal is not possible, or only to a very limited extent.

Hydrogen as a climate-friendly alternative is not expected to be ready for use until around 2030.

Steel is the basic material and starting point of almost all industrial value chains. An import stop of gas or an uncompetitive gas price would not only lead to production stoppages (see

ArcelorMittal), but also cause the collapse of industrial production in the EU.

The complexity of supply chains is often underestimated. The "bread before steel" strategy is far too short-sighted in an emergency.

Hubert Culik, Chairman of the FCIO

In Austria, the steel industry employs over 15,000 people (as of 2020). In addition, there are thousands of jobs in industries that need steel and iron as materials.

Voestalpine, Austria's largest steel producer, has already prepared well for the worst-case scenario.

For example, the company now also purchases gas from North Africa and buys liquefied gas from terminals in southern Europe. In addition, the group has secured gas reserves of 1.5 TWh, which have been stored in the RAG storage facilities in Haag and Haidach, among others. This amount is enough for three months of full operation or a correspondingly longer partial operation.

© Heavy plate,

Voestalpine

Conclusion: When gas fails, the economy comes to a standstill

Short-term alternatives for the shortfall of Russian imports are not available. Production was already curtailed in some sectors in 2021, when the gas price was still far below the current record price. In the meantime, some sectors have to suspend production completely - with drastic consequences in other industries.

Hundreds of thousands of jobs would be endangered by widespread production stoppages. The heating of private households, which ultimately depend on gas for only 20 %, would then become secondary in view of the economic upheavals. The shutdown of plants must therefore be avoided at all costs.

www.donauchem.at

Related links:

www.capital.de

www.donauchem.at

Related links:

www.capital.de (as of 29.09.2022)

Ausbau stockt: Hoffen auf ein Grüngas-Wunder (orf.at Stand 09.01.2023)