The transformation of the plastics industry towards a circular economy has picked up speed in recent months. Here is an overview of the course Austria has set with regard to plastic packaging and the drastic adjustments that the planned EU Packaging and Waste Shipment Regulation will require.

Plastic packaging: Recycling rates and recycled content

In Austria, almost one million tonnes of plastic waste are produced every year - with plastic packaging accounting for more than 300,000 tonnes, or about one third. 50,000 tonnes of this is just beverage packaging alone. More than 70 per cent is thermally recycled, the rest ends up in landfills.

1. Recycling rates

The recycling rate for plastic packaging in Austria is currently 25 per cent. However, the recycling rate only includes plastic packaging that is reused in a new product. According to the Packaging Ordinance, 50 percent of plastic packaging must be recycled by 2025, and 55 percent by 2030.

2. Recycled material content

For plastic bottles made of polyethylene terephthalate (PET), there are already targets for the recycled content according to the EU Single-Use Plastics Directive. This stipulates that every PET bottle should contain 25 per cent recycled material by 2025 and 30 per cent by 2029. In Austria, this quota is already achieved today. Stricter collection quotas also apply to plastic beverage packaging.

With the future "Packaging and Packaging Waste Regulation" presented by the EU Commission in November 2022, mandatory recycled content is also to be prescribed for all other plastic packaging.

According to a survey of plastics producers, the average recycled content of commercially available packaging is currently only 16.8 per cent. This is made up of 6.3 per cent recycled material from production and processing waste and 10.5 per cent recycled waste from consumers.

PET has the highest recycled content at 31.7 per cent. The other four types of plastic (PP, HDPE, LDPE and PS) have a share of 9.6 per cent to 13.5 per cent.

Figure 1.: At 31.7 per cent, the recycling shares for PET are still comparatively high - for the other types of plastic they range between 9.6 and 13.5 per cent.

Austria sets standards in PET recycling

Austria plays a pioneering role in bottle-to-bottle recycling. PET to PET Recycling Austria achieved a new recycling record last year:

32,900t of PET material from around 1.3 billion bottles were successfully recycled.

This means an increase in the volume processed of 20 per cent compared to the previous year (2021: 27,300 t).

Since 2021, levies have already had to be paid on non-recyclable plastic packaging according to the EU Single-Use Plastics Directive (SUP). From 2024, supermarkets will have to offer returnable bottles for all beverage categories. This will make it increasingly expensive not to recycle.

The majority of beverage packaging placed on the market in Austria consists of high-quality reprocessed used beverage bottles. PET to PET and other recyclers already produce beverage bottles from 100 per cent recycled PET.

PET has become a sought-after raw material. In 2021, the price of recycled PET has already doubled compared to new PET. A reusable PET bottle, however, only manages about 20 cycles, as some material is lost in further processing. According to a study conducted by the Austrian Ecology Institute on behalf of Greenpeace, about 1.4 old PET bottles are needed on average to produce one new re-PET bottle. So if in future all bottles in Austria were to be made from 100 per cent Re-PET, the material from Austria would not be sufficient.

This closes the circle to the rising prices and at the same time raises the question of Europe-wide transports for PET recycling. The EU is currently working on regulations for the cross-border shipment of waste that would make transport considerably more difficult.

Austria's recycling strategy pushes plastics recycling

One of the key building blocks of the Green Deal (2019) is the Circular Economy Action Plan (2020). As a significant component of the circular economy, the European Plastics Strategy aims to minimise the environmental impact of

plastics.

Plastic recycling plays a central role in this.

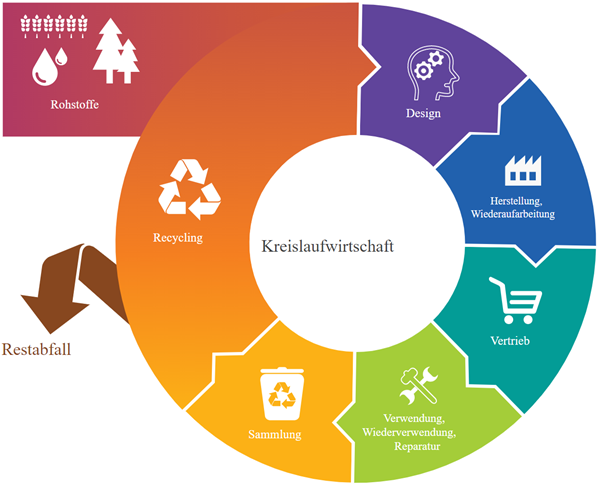

The goals of the Austrian Circular Flow Strategy

With the "Circular Economy Strategy - Austria on the Way to a Sustainable and Circular Society" adopted in December 2022, the framework for a circular economy and society has now also been created in Austria. At its core are four measurable goals:

- Target 1: Reduce resource use (reduce domestic material consumption (DMC) by 25% to 14 t/cap/a by 2030, reduce material footprint (MF) by 80% to 7 t/cap/a by 2050).

- Target 2: Increase domestic resource productivity by 50% by 2030.

- Target 3: Increase circularity rate to 18% by 2030 (based on reducing material use by about 20% and increasing recycling by about 10% compared to 2020)

- Target 4: Reduce material consumption in private households by 10% by 2030

Figure 2: Model of the circular economy, graphic: European Parliament

Impact of the Circular Strategy on plastics recycling

This results in various measures for plastics recycling. For example

- increase the reusable packaging quota,

- Eco-modulation (levies depending on the sustainability of the packaging) is to be introduced,

- the use of recycled materials is to be increased,

- and the volume of packaging is to be reduced.

In order to increase the use of recyclates, barriers to their use in food packaging are to be removed (although this can only be done at European level). The collection, sorting and recycling infrastructure is also to be massively expanded in order to be able to return more packaging to the cycle. In the course of the recycling pact, a uniform collection system for all plastic packaging was therefore decided upon.

New collection system to bring 20 per cent more yield

The low recycling rate for plastic packaging is due, among other things, to the fact that each federal province had individual regulations, which made sorting much more difficult. Since 1 January 2023, all plastic packaging must now be collected in the yellow bin or the yellow bag throughout Austria.

From 2023, companies will also be legally obliged to better separate and collect their packaging waste.

Industrial waste alone contains 50,000 tonnes of plastic that have not yet been recycled. In addition, plastic and metal packaging must be collected together throughout Austria from 2025.

Stricter collection quotas of 77 percent by 2025 and 90 percent by 2029 (currently 70 percent) apply to plastic beverage bottles. From 2025, a one-way deposit of 0.25 euros will be levied on plastic bottles and beverage cans. The containers can be returned wherever they were purchased. A handling fee is expected to be charged for vending machine returns.

By changing the collection system, the collection rate is to be increased by 20 per cent in order to achieve the prescribed recycling targets. Currently, according to ARA, the collection rate is 58 per cent, of which 58 per cent is sorted and then 78 per cent is recycled.

The goal is to increase the collection rate to 80 per cent by 2025. Of this, 80 per cent would have to be sorted and 80 per cent recycled in order to reach the specified recycling rate of 50 per cent. However, this will only be feasible with high investments in new sorting and recycling facilities.

And what will be used for heating in the future?

Waste incineration plants use the high energy content of plastic packaging to generate electricity and/or district heating. 1 kilogram of plastic replaces 1 litre of heating oil. If higher recycling quotas now apply, fewer plastics will end up in incineration.

Although this will reduce the calorific value and, in the short term, the quantities of waste, no bottleneck of waste for thermal recycling is to be expected in the future. Reasons for this include demographic developments, the landfill bans enacted by the EU, and the reduction of POP limit values, which means that certain input streams may no longer be recycled.

With the recycling of municipal waste, the amount of sorting residues is also growing at the same time, which account for a not inconsiderable share in all known recycling processes. In addition, neighbouring countries export municipal waste to Austria. The reasons for this are insufficient incineration capacities and difficulties with the implementation of recycling targets.

EU Waste Shipment Regulation makes plastic recycling more difficult

In January 2023, the European Parliament voted in favour of stricter rules on waste exports, mainly to boost the circular economy and fight waste crime inside and outside the EU.

Export ban and notification

The proposal to revise the Waste shipment regulation contains, among other things, an export ban on plastic waste to non-OECD countries, with a transitional period of several years planned for exports to OECD countries. In addition, plastics and other wastes containing persistent organic pollutants (POPs) are to be subject to the notification procedure within the EU in future.

Recycling associations are up in arms

Recycling associations see the recycling and circular economy in Europe seriously threatened if the proposed measures are implemented. In this regard, they cite the following reasons:

- Collection and recycling volumes could decrease significantly as a result of this approach and lead to the closure of recycling facilities, especially SMEs.

- There is a risk that primary raw materials will be used more and recyclers will face additional regulatory burdens.

- The possible loss of access to international markets could lead to a decline in demand and affect the profitability of recycling.

- The tightening of shipment rules for plastics containing POPs is also viewed critically, as these apply regardless of the concentration level of the pollutant. In practice, this would mean that almost all shipments of waste for recycling within the European Union would have to be notified, i.e. subject to the prior notification procedure.

The new Waste Shipment Regulation would thus not bring the hoped-for simplification, but would lead to further bureaucratisation and additional challenges for recyclers. Some even speak of the end of plastics recycling in Europe. It remains to be seen whether those responsible in the EU member states will support the EU's proposals.

EU Packaging Regulation brings significant tightenings

As part of the Green Deal, the EU Commission presented a proposal for the new EU Packaging and Packaging Waste Directive (PPWR) on 30 November 2022. Unlike the currently valid EU Packaging Directive, the planned regulation does not have to be transposed into national law - according to the draft, it is already directly applicable in all member states on the 20th day after it comes into force.

The draft contains rules for the entire life cycle of packaging - from environmentally friendly design to efficient recycling:

- Waste reduction: The overarching goal is to reduce packaging waste generated through reuse and recycling by at least 15 per cent by 2040 (compared to 2018).

- Single-use and reusable packaging: The circular economy is to be promoted through the use of reusable packaging and the banning of many single-use packaging. Plastic packaging for products such as fruit and vegetables will be banned.

- Recyclability: Packaging is to be fully recyclable without exception by 2030 at the latest.

- Packaging recycling requirements: These include, for example, criteria for packaging design, labelling requirements and mandatory deposit systems for plastic bottles and aluminium cans.

- Mandatory recycled content: In addition, there will be mandatory recycled content that manufacturers must include in new plastic packaging. From 2030 onwards, plastic packaging is to contain 35 percent recycled material, and a value of at least 10 percent applies to food packaging.

For brand owners and retailers, the PPWR will bring enormous changes:

- Packaging of all packaging materials is classified in category A (recyclability > 95%) to category E (recyclability < 70%).

- Category E packaging is considered non-recyclable and may no longer be placed on the market from 2030.

- Ecomodulation of royalties, which reflects the recyclability of packaging, is based on these categories.

- Harmonised designs for recycling criteria are emerging across Europe.

- The use of plastic recyclates is being promoted.

Companies now have binding minimum requirements for the first time and are therefore well advised to have their packaging assessed with regard to the new requirements (especially recyclability, recycled content, carbon footprint, packaging weight).

Innovations: Circular Economy for plastics

A large number of projects are currently working on the more efficient use and better recycling of plastics. In the meantime, innovations along the plastics value chain are presented almost daily. Important approaches are sustainable product design, improved waste sorting technologies or novel recycling processes. Some examples:

1. Sorting facilities as a key factor

High-tech sorting plants are a prerequisite for increasing recycling rates. Europe's most modern sorting plant for light packaging is currently being built in Ennshafen, Upper Austria, which will achieve a sorting depth of 80% - significantly more than the current plant infrastructure in Austria (58%).

The fully digitalised high-tech plant is equipped with the latest near-infrared sensor technology and can recognise 20 different waste fractions with the help of artificial intelligence and separate them by type.

With a capacity of 100,000 tonnes per year, the plant will cover 50 per cent of Austria's sorting capacity for light packaging. It will thus play a key role in achieving the EU recycling target. The investment volume is around 60 million euros, and the planned start of operations is 2024.

2. Design for Recycling

This complex of topics includes recyclable products and packaging, sustainable design (recyclability, product as a service, etc.), intelligent packaging (recycled content, etc.), labelling standards (digital watermark, pictograms, etc.), reusable alternatives as well as closed and open loop systems.

Berglandmilch, for example, was the first company in Austria to develop the K3® cup in cooperation with the packaging manufacturer Greiner. No colours or imprints were used; instead, the recyclable cup is wrapped in a peelable cardboard sleeve that detaches itself during the collection process. This makes the cup optimally recyclable.

Another exciting project is the

HolyGrail 2.0 initiative, where more than 160 well-known companies are now working to develop digital watermarks on packaging. The marking contains valuable information that is passed on to sorting plants to increase recyclability.

Innovations, however, are not only a matter for large corporations. For example, the family-owned company

Puhm GmbH from Lower Austria has developed collection sacks for mineral wool residues and other demanding applications made entirely of recycled plastic. The bags are in no way inferior to polypropylene film bags.

Figure 3: The K3® cup enables the sorting and recycling of paper and cardboard that ends up in the light packaging recycling stream. © Greiner AG

3. Innovative recycling processes

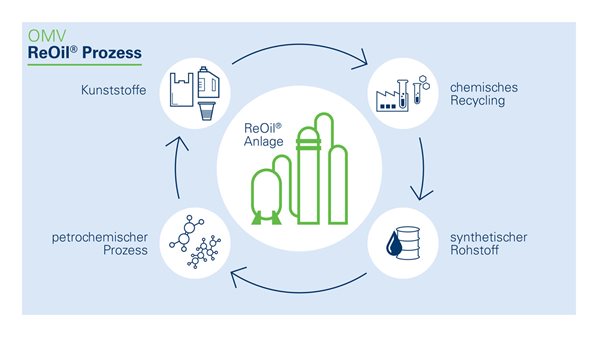

Chemical recycling as a complement to mechanical recycling is on the rise. Corresponding capacities must first be built up and fundamentally new recyclable materials must be developed. Another promising process is cryogenic recycling for the preparation of material composites through cryogenic grinding.

However, for the scaling up of chemical recycling, an overarching recognition of the mass balance approach for the chemical recycling of plastic waste is required within the framework of the EU Single-Use Plastics Directive and other EU regulations. This is currently still pending.

The chemical process is suitable for polyurethanes (PU) and other thermoset products that cannot be mechanically recycled. Covestro, for example, has developed innovative technologies for the chemical recycling of polyurethane foams from used mattresses.

OMV is also increasingly focusing on chemical recycling. Since 2017, the company has been operating the pilot plant "ReOil" for the production of crude oil from plastic waste. Now, an economically viable large-scale plant for the chemical recycling of plastic waste is to be built at the Schwechat refinery site by 2027.

Figure 4: ReOil® process using chemical recycling © OMV

Conclusion: Massive changes in plastics recycling through circular economy

The road to a circular economy will not be an easy one. Producers and processors will have to adapt to increased recycling rates, eco-design and mandatory recyclate volumes, which will require significant optimisation of packaging. At the same time, the shipment of waste for recycling will become more difficult. Consumers, in turn, will have to pay a deposit in the future and do without many disposable packages.

www.donauchem.at

www.donauchem.at