Donauchem has been active in the coating industry for years and considers it to be one of its focus sectors, together with the entire paints/construction industry. We currently offer a compact but very interesting portfolio for industrial applications, which is constantly being expanded. In addition to our increased commitment in the area of research & development, we will focus our attention on expanding our specialities-portfolio. Therefore we take this as an opportunity to take a closer look at the coating industry, where it currently stands and what challenges lie ahead in 2021/2022.

Coating industry in Austria

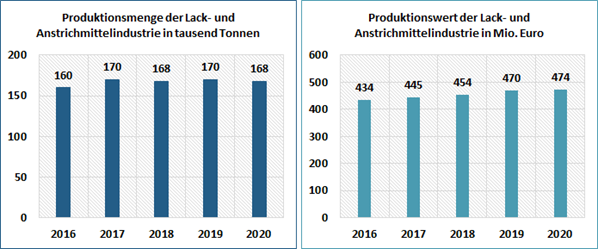

With a total production of about 168,000 tons and a production value of 474 million euros, the Austrian coating industry is one of the most important pillars of the chemical industry in Austria. This remarkable economic performance is due to 25 Austrian coating companies with about 2,700 employees. The companies are mainly located in Lower Austria (8) and Upper Austria (6). Another eleven companies are distributed among the provinces as follows: Vienna (2) Salzburg (2), Styria (2) Carinthia (2), Vorarlberg (2), Tyrol (1). Furthermore, there are a lot of small and medium-sized enterprises within this industry in Austria.

Source:

Statistik Lackindustrie 2020, FCIO

Innovative pioneer in Europe

With investments in research and development of 10 to 15 percent of turnover, the industry is innovation-oriented and employs a large part of the workforce in this area. With new developments and high-performance products in coating, the Austrian coating industry now plays a pioneering role in Europe.

The intensive research and development activities combined with high product quality have ultimately also contributed to a significantly increased export volume to the European Union and Eastern Europe. Exports increased by 12.2 per cent to 92,000 tonnes in 2020 despite the difficult general conditions. This corresponds to 55 percent of the total production volume. There was a high growth of 12.8 percent in exports to Germany, the most important trading partner of the Austrian coating industry.

The drivers of innovation are above all higher demands on product safety and environmental compatibility of production processes. Innovation activities also focus on the environmental and resource-saving applicability of products. Only recently, a lighthouse project was launched to recover and recycle paint containers from users.

Another industry project is researching sustainable means of preserving paints. The background to these efforts is the elimination of active substances due to chemicals legislation and the Biocide Ordinance. This would mean that especially the environmentally friendly water-based paints would have to be stored in the refrigerator unless alternatives are found.

In addition, the Responsible Care initiative of the Chemical Industry Association has also been well received by the coating industry. The industry is explicitly committed to the guiding principle of sustainable development and has been advocating "responsible action" and improvements in the areas of environment as well as safety and health of employees and customers for many years. The Donauchemie Group is also one of the initiative's supporters.

Coating industry on the up again in 2021

The year 2020 was overshadowed by worldwide shutdown measures in the wake of the Corona pandemic. Manufacturers of industrial coatings and printing inks in particular suffered drastic losses in 2020. In contrast, there was an upswing in the architectural coatings sector.

Despite the massive drop in sales in the first quarter, the domestic coating industry made up for the losses in the second half of the year and achieved a sales increase of 0.8 per cent compared to 2019. However, production volume fell by 1.3 per cent compared to 2019 to 168 million tonnes. The increase in sales with simultaneously lower production volumes thus also reflects the increased raw material costs.

Source:

Statistik Lackindustrie 2020, FCIO

Since spring 2021, the industry has been on an upward trend again. This also applies to the automotive coatings segment, which recorded a 15 % decline in global production volume in 2020. According to the consultancy firm Kusumgar, Nerlfi & Growney (KNG), the volume is expected to rise steadily again to 2.52 million tonnes and a value of almost EUR 12.3 billion by 2024. The average annual growth rate of the automotive coatings market is about 3 per cent per year.

Precarious raw material situation inhibits growth

In view of the tense raw material situation, the Corona crisis will remain the predominant topic in the industry in 2021, alongside chemicals legislation and the Green Deal.

Raw material costs are crucial for the coating industry, as they account for more than 50 % of product costs. Currently, the industry is suffering from extremely

limited raw material availability and the resulting high costs. Due to the economic upswing in China and Southeast Asia, many raw materials do not reach Europe, but are delivered directly to the best suppliers in Asia.

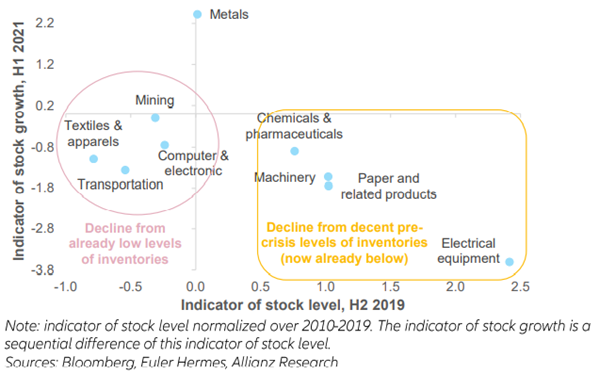

Worldwide hoarding put additional pressure on Europe's raw material supply. US companies are currently leading the race for goods and raw materials: according to

the latest Euler Hermes study on global trade in 2021, deliveries from Asia to the USA will increase by about 30 %, to Europe it will only be about 10 % more due to the much later opening.

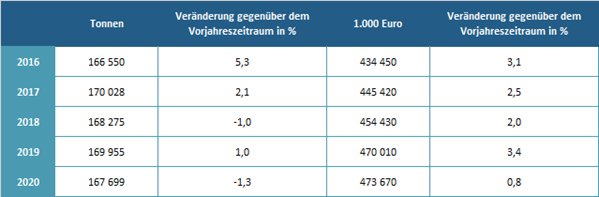

Accordingly, many companies in Europe are struggling to replenish already low inventories. The sectoral inventory indices in the chart below clearly show a decline in inventories in the chemical-pharmaceutical industry compared to pre-crisis levels.

Source:

Euler Hermes Studie zum globalen Handel 2021

The situation is exacerbated by force majeures among commodity producers, Corona-related port closures in China and the ongoing container shortage, which has led to a huge increase in ocean freight costs from Asia to Europe. As transport capacities cannot be increased in the short term, further bottlenecks are expected until 2022. Packaging has also become more expensive due to higher prices for plastics and steel.

Source:

Euler Hermes Studie zum globalen Handel 2021

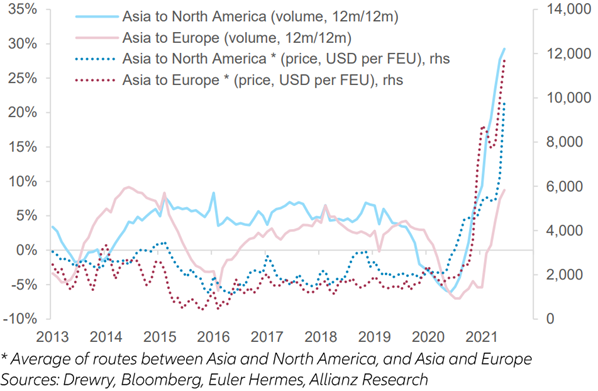

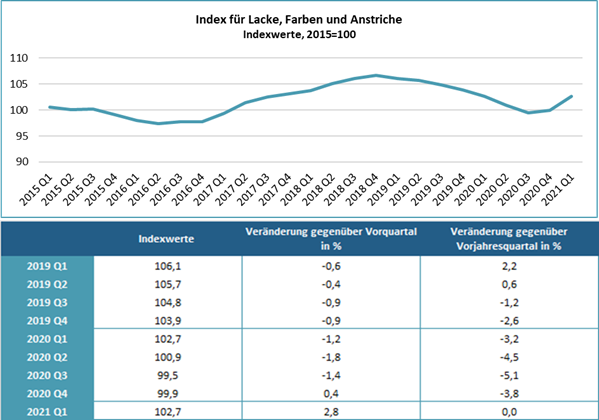

Raw materials index: plus 2.8 percent in the first quarter

The Austrian raw materials index of the WKÖ statistics for the coating industry illustrates how the shortages of raw materials have been reflected in price increases since December 2020. More and more manufacturers are already having to pass on the price increases to the market. The price adjustments for base or clear coats already range between 3 and 8 percent, for coating by-products such as primers (+12%), thinners or cleaners (+15%) the price spiral is partly even higher.

Source:

Destatis, WKÖ-Berechnungen

The commodity index of the WKÖ statistics measures the average price development of raw materials and industrial products and can be used for price adjustments. The calculation basis is the index for producer prices for industrial products from Destatis, as the data of the Austrian producer price index are not available in the required level of detail. Recourse to the index of the German Federal Statistical Office is permissible insofar as the raw material price developments in Austria and Germany are identical due to the similar supplier structure.

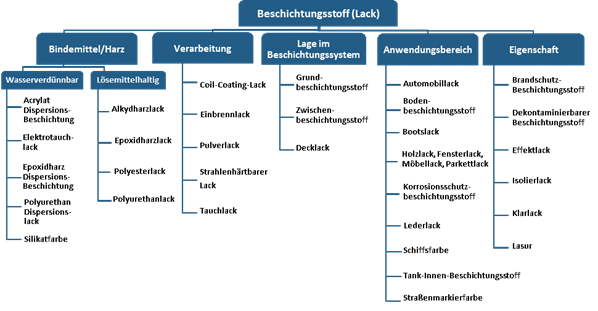

The range of "Made in Austria" paints and coatings

In addition to the visual design of surfaces, coatings are mainly used to protect and maintain the value of goods. The areas of application of coatings are extremely diverse - from floor and metal coatings to wood and plastic varnishes, painters' varnishes, wall paints and plasters:

Source:

Wissenswertes über Beschichtungsstoffe, FCIO

1. Floor coating

Coatings in the floor segment are primarily intended to protect against mechanical stress and must therefore have a corresponding resistance. Areas of application can be found in public facilities (garages, car parks, schools) and in the private sector (parquet floors, wooden floors). Important here is protection against chemicals, oil, petrol (car parks), but also against food (kitchen). Epoxy resin coatings, polyurethane coatings (PUR), but also water-based coatings (acrylates) are used for this purpose.

2. Metal coating

In the case of metal coatings, a distinction must be made between coatings for automotive & vehicle construction and industrial coatings (machine and equipment industry, bridge construction, shipbuilding, roof coatings, metal constructions in halls and power plants, container coatings, etc.). The functions of metal coatings range from design and corrosion protection to scratch resistance and weather resistance. Polyester coatings, acrylate coatings, alkyd resins, PUR, but also water-based coatings and powder coatings are used in this area.

3. Plastic coating

Plastic coatings are becoming increasingly important for automotive interiors (interior fittings), home interiors (kitchens), toys, sports articles, consumer goods, electronics (!), plastic flooring and much more. Here, mainly water-based systems such as water-based acrylate or PUR systems are used.

4. Wood coating

In addition to the visual impression, the protection of wooden constructions against the effects of weathering is the main focus of wood coatings. Suitable for this area are water-based acrylate systems, alkyd resins, PUR dispersions, but also many solvent-based systems (because of their resistance).

5. Paints/wall paints/plasters

For interior paints, wall paints and plasters, dispersion paints based on acrylates and styrene acrylates, but also silicate-based paints (silicate paints) are used. Especially for exterior paints and plasters, weather resistance and water-repellent properties are in the foreground (also for building protection, preservation of historical monuments). In these areas of application, acrylate, styrene-acrylate and silicate systems are also mainly used.

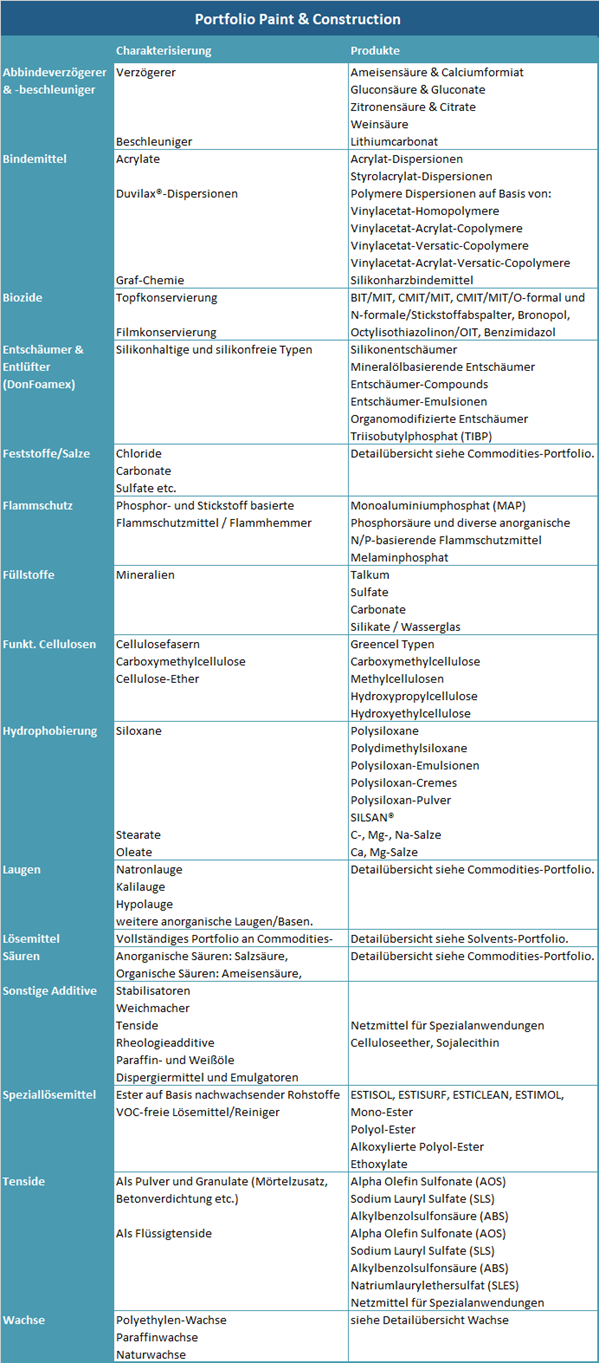

The Donauchem portfolio for the coating industry

Our portfolio is compact and will be expanded in the future with specialities such as the recently introduced Deurex waxes. With our storage capacities we are able to supply our customers even when the raw material situation is tight. For specific questions about our range, please

contact us.

www.donauchem.at

Weiterführende Links:

www.donauchem.at

Weiterführende Links: