A few days ago, Russia announced that it would ban exports of products and raw materials until 31 December. It is currently unclear what will be affected. According to initial estimates, the export ban could apply to oil, gas, grain, metals and a number of important raw materials. Should this actually happen, it would have serious consequences for the energy and raw materials supply in Austria and Europe.

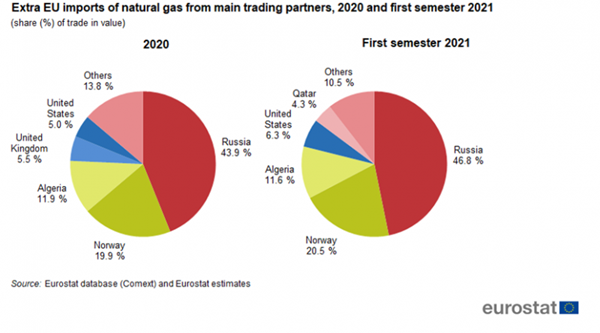

Russia is the EU's largest supplier of natural gas

Europe is highly dependent on Russia's oil and gas exports. Given that energy prices in the EU have already risen from 20 euros to 180 euros per megawatt hour in the past year, the loss of these gas and oil imports could be a heavy burden for Europe.

Austria receives 80 per cent of its natural gas from Russia

Russia was the largest supplier of natural gas to the EU in both 2020 and the first half of 2021. According to Eurostat, around 44 per cent of European natural gas imports came from Russia in 2020. In the first half of 2021, this share rose to almost 47 per cent. According to the WKO, Austria procured around 80 percent of its natural gas from Russia in 2021.

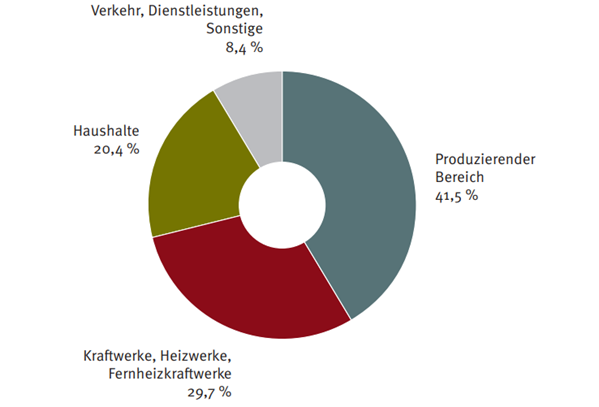

Industry and power plants as the largest gas consumers

The main consumer of gas in Austria in 2020 was the manufacturing sector with a share of 41.5 percent. This sector uses natural gas to generate process heat or as a raw material in production. 29.7 percent of the total gas demand in 2020 was used in the transformation sector for electricity and district heating generation. For households (20.4 percent of gas demand), the main applications are space heating, water heating and cooking.

Source:

Zahlenspiegel Gas und Fernwärme 2021

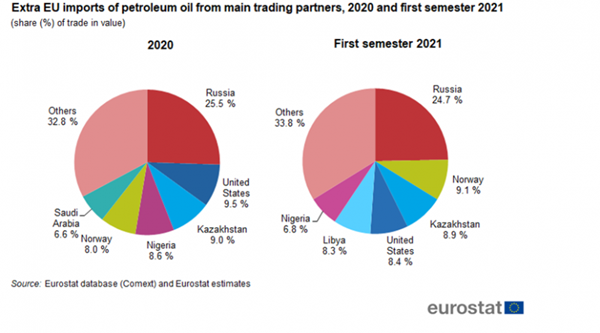

Austria imports 10 percent of its oil from Russia

For crude oil, Russia is less dominant than for natural gas, with an EU import share of around 25 percent, but still far ahead of the second largest supplier, Norway. Austria purchased a total of 7.84 million tonnes of crude oil from Russia in the period 2010 to 2020, which corresponds to about 10 percent of all crude oil imports.

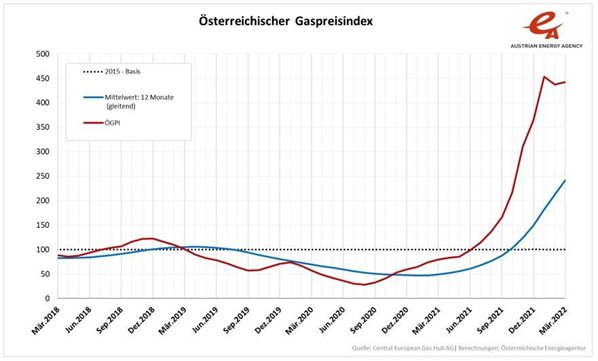

Natural gas price skyrockets by 60 per cent

Even before the Ukraine crisis, the price of gas had risen significantly. At the end of 2021, the price was around 148 euros per megawatt hour; the long-term average was between ten and 25 euros. In the first week of March 2022, the gas price reached the 200 euro per megawatt hour mark for the first time.

Traders' fears that gas deliveries to Europe could be interrupted caused the gas price to shoot up again by 60 per cent just a few days later. At the Dutch trading point TTF (Title Transfer Facility), a megawatt hour was temporarily traded for 345 euros (7.3.2022).

The Austrian

Gas Price Index (ÖGPI) is currently 455.5 percent higher than in March 2021.

Political decisions and fears are also the main drivers of oil price increases. As of 10 March 2022, the price of a barrel (159 litres) of North Sea Brent crude is 113.29 US dollars, while the price of a barrel of US West Texas Intermediate (WTI) crude is 109.90 dollars. The first effects are already reflected in petrol and special petrols with a price increase of 40 percent.

Liquid gas by tanker as an alternative?

Supplying Europe to a large extent by LNG tanker is hardly feasible logistically and economically at present. LNG involves enormous costs and Europe has to compete with other gas-consuming regions for scarce supplies.

In Europe, the main bottleneck is the number of LNG terminals. These are needed to convert the LNG back into a gaseous state and feed it into the gas grid. According to an ICIS study, even if all available LNG terminals were fully utilised, only 40 percent of Europe's gas demand could currently be covered by LNG if Russian natural gas imports were to cease.

Importing more gas from overseas is thus not a real option due to limited transport and conversion capacities. Moreover, according to Commerzbank experts, increased LNG imports would not be able to compensate for possible shortfalls in Russian pipeline deliveries anyway, as Russia currently accounts for around one-fifth of the EU's LNG imports. These volumes would have to be additionally compensated for in the event of a possible supply embargo.

Economic disruptions in energy-intensive industries

For energy-intensive industries such as the chemical industry, the Ukraine crisis could become extremely difficult should gas become scarce or significantly more expensive in Austria and Europe. Although Russian gas is currently still flowing to Europe in large quantities, a reduction or halt in deliveries can no longer be ruled out.

The gas price shock is now a huge problem for the chemical industry. The industry is already burdened by historically extremely high natural gas prices and rising electricity costs. Production was already curtailed in some sectors in 2021, when gas prices were still far below current prices. A continued rise in energy prices could lead to companies not only having to cut production for cost reasons, but to suspend it completely.

First companies are already cutting production

The first declines in production are already evident in processes that are heavily dependent on natural gas. At present, this mainly concerns electrolysis products, sulphuric acid and nitrogen products:

1. Electrolysis products

The production of electricity-intensive electrolysis products such as caustic soda and caustic potash is indirectly affected by the rising energy costs for gas due to the coupling of gas and electricity prices.

2. Sulphuric acid

Sulphuric acid is produced in the energy-intensive

double-contact process. As one of the most important raw materials in chemical technology, a further shortage would have a serious impact on numerous industries.

3. Nitrogen products

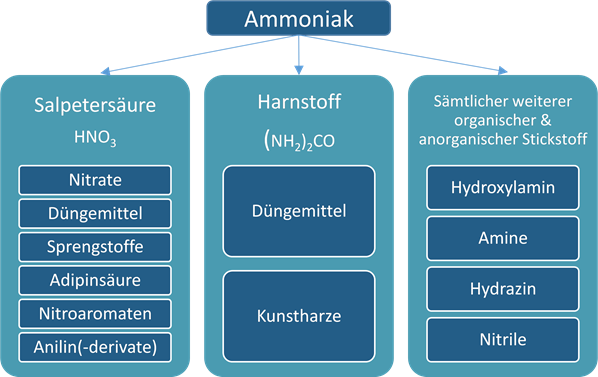

Ammonium, the basis of

nitrogen products, is directly dependent on natural gas in the manufacturing process. Initial price increases of more than 40 per cent for nitrogen products have already been recorded. If, as a result of high gas prices, there are production losses in ammonium and urea production, this will have a direct impact on the production of AdBlue. Thinking further, this would lead to a massive restriction of truck traffic.

Without nitrogen products, fertilisers could also no longer be produced. The rising price of natural gas is already leading to a reduction in fertiliser production and causing food prices to rise. In combination with the

phosphoric acid shortage, this means an additional burden for the fertiliser industry.

In addition, the EU buys about 30 per cent of its fertiliser from Russia. Russia is one of the world's most important exporters of fertilisers and important intermediate products. Russia produces 23 per cent of the world's ammonia and 14 per cent of urea. Russia also produces 21 per cent of the world's potassium salts.

Feedstock for petrochemical production in Europe at risk

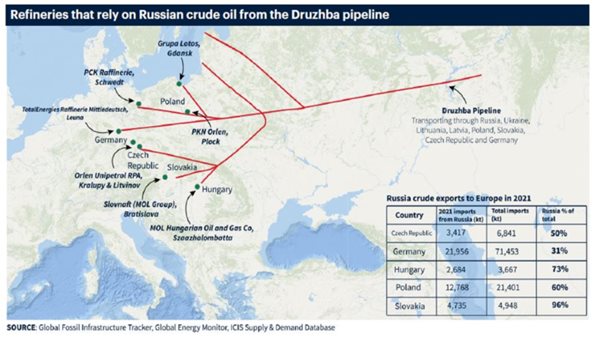

The Ukraine crisis has not only resulted in rising energy prices, but could also seriously threaten petrochemical production in Europe. The embargo of oil and gas from Russia currently under discussion would hit refineries in Europe hard. Several pipelines would be affected at the same time.

1. Gas pipelines

In one fell swoop, gas supplies from at least three major gas pipelines (Yamal Europa, Nord Stream 1, Bratstvo/Urengoy-Uzhgorod) would come to a halt. The Progress and Turkish Stream pipelines may also come to a standstill.

2. Oil pipeline

Crude oil deliveries via the Druzhba pipeline would also be interrupted in the event of an embargo.

3. Refineries stand stil in the event of an embargo.

All refineries in Hungary, Slovakia, the Czech Republic, Poland, eastern Germany (Leuna) and Austria would no longer receive feedstock for the production of petrochemicals from natural gas and crude oil. The supply of basic chemicals to large parts of Europe would thus be under massive pressure. At the same time, an embargo would probably also eliminate all basic chemicals such as inorganics and petrochemicals that are imported from Russia.

No petrochemicals - no chemical production

Cutting off natural gas and oil supplies from Russia would have a direct impact on the availability of gasoline/hydrocarbons and many other organic synthetic base chemicals. However, this would only be the beginning, as almost all chemical processes today are based on petrochemical feedstocks (see:

petrochemical flowchart).

1. Shortages in olefins

In particular, constraints are to be expected for ethylene and propylene. According to

ICIS data, 2.79 million tonnes of ethylene (11 per cent of total European capacity) and 2.34 million tonnes of propylene (12 per cent of total European capacity) are expected to rely on refineries along the Druzhba pipeline in 2022. Although some alternative sources of crude oil could be procured, it is unlikely that normal operating levels could be maintained.

Ethylene and propylene are important base products for chemical reactions. A shortage would affect all other streams, e.g.:

- Ethylene oxides - Ethanolamines - Glycols - Polyesters - All solvents.

- Styrene monomer - Polystyrene (Styrofoam)

- Acrylonitrile - Rubbers/Plastics,...

- Cumene - Phenol - Acetone - all derivatives

- Propylene oxide - Glycols - all solvents

- Butadiene - Rubbers/Plastics

Olefins are essential for the production of plastics, fertilisers, coatings, clothing, packaging, detergents, pharmaceuticals, fuel and much more.

2. Shortages of aromatics

Similarly, all aromatics such as benzene, toluene and xylene and their derivatives would be affected by a refinery shutdown. Aromatics are used to produce polymers, synthetic resins and polyesters and are also used, for example, in the production of electronics, coatings, sports equipment or textiles.

Conclusion: Effects of the Ukraine conflict

Due to current developments, the chemical industry in Austria and Europe must prepare for further increases in gas prices. In the event of a halt in gas and oil supplies from Russia, the industry faces three main problems:

First of all, gas prices would presumably rise extremely, making it no longer worthwhile for many companies to produce. Secondly, European refineries would no longer be able to produce, which would lead to a shortage of important basic chemicals. In addition, there could be state-imposed forced shutdowns for the benefit of private households. A Russian export ban on fertilisers and important chemicals such as ammonium and urea would also hit agriculture in particular and cause food prices to rise again.

www.donauchem.at

Additional links:

Raus aus dem Gas - orf.at 14.03.2022

www.donauchem.at

Additional links:

Raus aus dem Gas - orf.at 14.03.2022