In a networked and digitalised world, nothing works without semiconductors - chips are the new oil of the global economy. But although the demand for semiconductors is booming enormously, manufacturers are not managing to meet the demand. In continuation of our blog

Why Donauchem focuses on chemicals for PCB production, in this article we shed light on the current situation with regard to raw material availability and other relevant influencing factors.

Furthermore, we give an outlook on the predicted development of the semiconductor industry and related sectors.

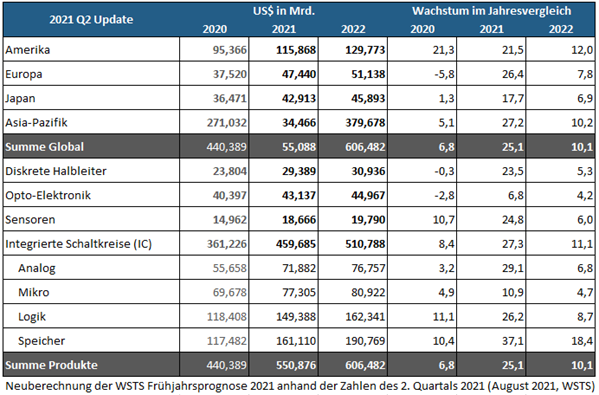

Semiconductor market: growth rate of 25 percent in 2021

Up to now, the chip industry has calculated an annual sales growth of up to five percent. After growth of 6.8 percent in 2020, the industry association

World Semiconductor Trade Statistics (WSTS) expects the global semiconductor market to grow to 551 billion US dollars in 2021.

This corresponds to a global growth rate of 25.1 per cent for 2021. The biggest growth drivers are memories with 37.1 per cent, followed by analogue chips with 29.1 per cent and logic chips with 26.2 per cent. According to these forecasts, Europe will recover in 2021 with market growth of 26.4 per cent.

For 2022, analysts expect the global semiconductor market to grow by 10.1 per cent to 606 billion US dollars. The main driver is the memory category with double-digit growth. Europe is expected to show a positive growth rate of just under 8 per cent in 2022.

Semiconductors mainly consist of four components: Discrete semiconductors, optoelectronic devices, sensors and integrated circuits (IC). Integrated circuits account for more than 80 percent of devices and are in turn categorised by four product types: Analogue Devices, Microprocessors, Logic Devices and Memory. Chips is the common generic term for these IC categories.

Fig.: A printed circuit board or circuit board consists of various semiconductors whose individual functions enable complex systems.

Intensification of the poor supply of raw materials for semiconductors

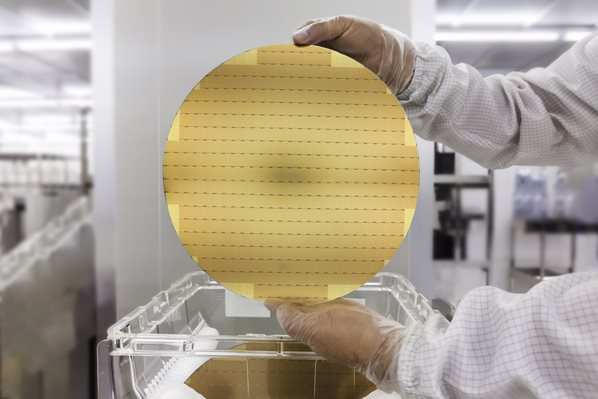

A semiconductor chip is essentially composed of integrated electronic circuits (IC) mounted on a small silicon wafer. Depending on the type of semiconductor, 400 to 1400 steps and about 300 to 400 different chemicals are required to make it. On the other hand, 50 different types of manufacturing machines are necessary.

The ongoing shortage of raw materials is affecting production for a wide range of components, causing bottlenecks especially for ICs, CPUs and memories:

ABF substrate bottleneck

The material base for semiconductors is primarily high-purity silicon, which in turn requires the ABF substrate for further chip production. ABF substrates are currently the dominant technology for high-performance processor applications. As the capacity limit of substrate manufacturing facilities has been reached, analysts expect the shortage to continue until 2023.

8-inch wafer bottleneck

In addition to the substrate bottleneck, semiconductors are affected by a global shortage of 8-inch wafers. Over the past decade, fabs for advanced 12-inch wafers have sprung up in particular. However, many semiconductors require smaller silicon wafers. In the wake of high demand, there is now a lack of machines to process 8-inch wafers. Manufacturers are therefore turning to second-hand machines as far as possible, and the delivery time for new equipment is currently up to one year.

Raw materials for plastics production

Besides shortages of chemicals for the surface treatment of printed circuit boards, such as potassium peroxomonosulphate and high-purity hydrochloric acid, there are also restrictions on chemicals used in the production of plastics.

Certain plastics are also needed in the production of semiconductors, e.g. for PCBs, electrical insulators, ultrapure water systems and wet benches, to name a few. If these plastics remain in short supply, many semiconductors can no longer be produced.

Fig.: Silicon wafer being prepared for chip production.

Chip shortage leads to price increases of up to 20 percent

Chip inventories are currently at an all-time low. Chips go straight into end-use production after completion. Managers of major semiconductor manufacturers such as Intel CEO Pat Gelsinger and Infineon CEO Reinhard Ploss expect supply shortages to last well into next year, if not beyond.

Several manufacturers have already announced that they will raise chip prices by 10 to 20 per cent. The main reasons for this are to be found in the following factors in addition to the availability of electronics-grade raw materials:

High demand and cryptocurrency boom

The constant growth in demand from various sectors such as 5G, automotive and IoT is one of the main causes of the chip shortage. In addition, there was a significant increase in crypto mining activities in 2021. As a result, the global supply of semiconductors has been put under additional pressure. GPU and memory manufacturers are already starting to develop products focused on mining applications.

Too few factories due to consolidation in the industry

The production of a semiconductor takes place in three stages: First comes the technical design, then the manufacturing, finally the housing and attachment of contacts, the so-called packaging. Consolidation within the industry has now resulted in only a handful of companies operating fabs. This is because many chip companies focus only on design and leave the production of their designs to these large manufacturers.

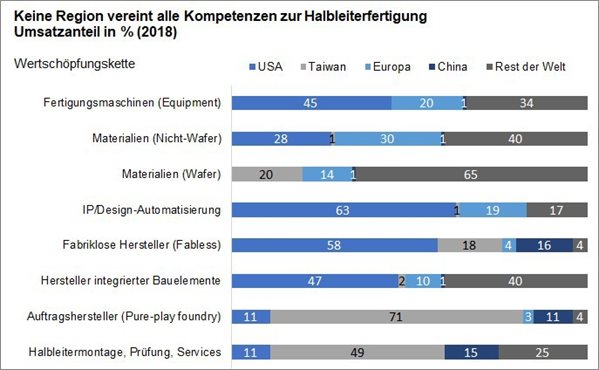

While specialisation brings competitive advantages, it also means that semiconductor companies are highly interdependent. According to McKinsey, no local market or local company has all the skills needed for end-to-end semiconductor design and manufacturing. The share of world regions (in %) in value chain sales shows this very clearly:

Source:

Gartner, IHS, Strategie-Analyse McKinsey

Uneven technology development

A key cause of the current bottlenecks also appears to be uneven technology development across the ecosystem. Not only does this mean that some regions specialise in certain technologies, but there is also a mismatch with some countries using older chip manufacturing processes. This technological disparity between global locations creates the risk of significant supply chain disruption, as was the case during the Covid 19 crisis. It therefore makes no sense to only increase capacity in certain regions. Long-term, global solutions must be found.

China - USA conflict

Another reason for the global chip shortage can be found in the conflict between China and the US. Former US President Donald Trump's threat to impose sanctions on China led to hoarding purchases by the Chinese tech and electronics industries. As a result, the just-in-time production of large international corporations came completely out of sync.

Natural disasters and corona-related supply chain problems

Corona-related supply chain problems and unforeseen natural disasters continue to plague the semiconductor industry. Major semiconductor manufacturing countries such as East China, Malaysia, Vietnam, Thailand, the Philippines and Singapore are facing disruptions from corona outbreaks, floods and typhoons. Taiwan is also dealing with the effects of the worst drought in more than half a century.

Taiwan holds a prominent position with nearly two-thirds of global contract manufacturing capacity. Major manufacturers such as TSMC, UMC, Winbond and Samsung have their factories located on the island. TSMC is the world's largest producer of microcontrollers, which are particularly lacking in the automotive industry.

Which industries are most lacking?

Integrated circuit (IC) chips are part of all devices and machines that have some level of microprocessor control. Numerous technologies simply do not work without them. Supply shortages of semiconductors are therefore plaguing many industries worldwide. One of the hardest hit sectors is the automotive industry. But also computer and mobile phone producers or household appliance manufacturers are now struggling with the lack of supply of electronic components.

Short-term recovery of the automotive industry unlikely

After the auto industry reduced its orders during the Corona Lockdowns in 2020 and quickly increased them again in 2021, the first shortages of microchips occurred. The fire in a chip factory in Japan, which is important for the car industry, then slowed down car production again worldwide in spring 2021, especially in Europe and the USA.

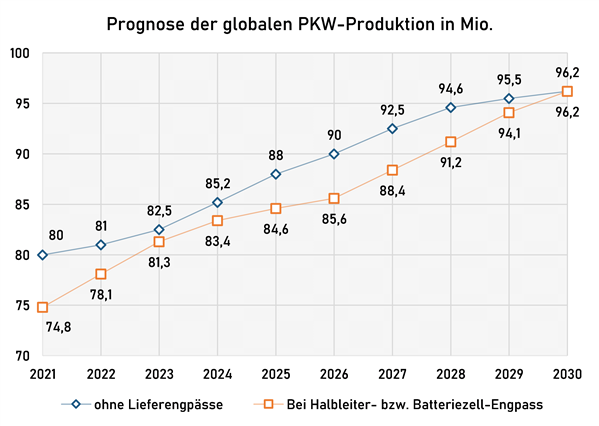

Meanwhile, despite full order books, carmakers are having to switch to short-time work, stopping their assembly lines for weeks at a time or shutting them down completely. Ferdinand Dudenhöffer of the Center Automotive Research (CAR) in Duisburg estimates that 5.2 million fewer vehicles will be built worldwide this year than planned due to the semiconductor shortage. In addition, the automotive expert expects supply problems in car production by 2030.

He blames this on the one hand on the semiconductor shortage, which will have an impact by the beginning of 2023, and subsequently on problems with the availability of battery cells. For the year 2026, Dudenhöfer forecasts a worldwide demand of 90 million vehicles. According to his data, however, manufacturers will then only be able to produce 85.6 million cars.

Source:

CAR Duisburg

The German management consultant PwC is also extremely sceptical about the production plans of the car industry in view of the semiconductor crisis. The expansion of semiconductor production facilities takes up to two years, the construction of new plants even five years - therefore no quick recovery of the supply of semiconductors is expected.

Production downtime for computers, IoT devices and white goods

In addition to carmakers, mobile phone manufacturers are also having to cut back production due to the chip shortage - with the exception of the Apple Group, which stocked up on semiconductor components in good time. Producers are therefore currently concentrating on flagship devices and 5G-capable smartphones, while bottlenecks are looming for low-cost devices. Samsung and Xiaomi are already stopping the production and sale of mid-range and low-cost smartphones in some markets.

Similarly, game consoles are hardly available three quarters of a year after their release because of the chip shortage. Delivery problems due to semiconductor shortages are now also clearly noticeable in laptops, printers, WLAN routers, e-bikes and household appliances. Ultimately, the chip shortage affects all "white goods". Since many companies have been producing for stock, certain household appliances are likely to be in particularly short supply with a time lag for Christmas.

Fig.: Automated production process of circuit boards/microchips for electronics or computers.

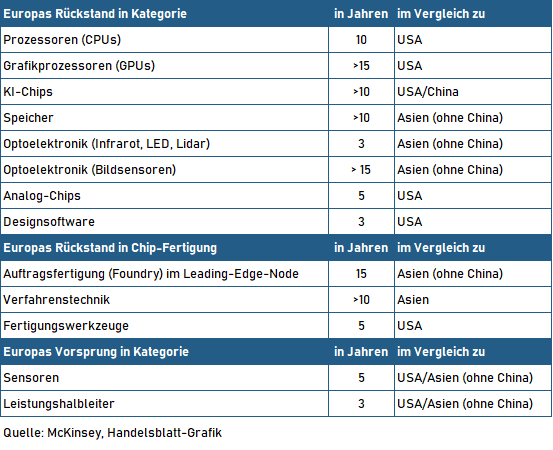

European chip industry lags up to 15 years behind

Europe's dependence on American and Asian chip manufacturers will not change any time soon. European chip companies only have a ten percent share of the world market and are lagging years behind in many areas. According to a study by the management consultancy McKinsey, it will take at least ten years before Europe can catch up with the world leaders.

To reach the most advanced level of manufacturing, McKinsey reckons with up to 15 years lead time. The only exceptions would be power semiconductors (Infineon) and sensor technology (Bosch, ST Microelectronics, Infineon). In these areas, Europe plays a leading role worldwide, with a lead of three to five years over Asia and the USA.

New chip factories: Long construction times and a lot of money

The capacity utilisation of many factories was already at 80 to 90 percent before the demand boom, because anything below that is uneconomical. This is also the reason why the fabs are currently running at full capacity. Building a new chip factory - like those operated by the big manufacturers in Asia and the USA - costs about 10 to 15 billion euros and takes several years. In addition, between 3,000 and 6,000 employees have to be recruited and trained. New factories can therefore only relieve the chip shortage from a long-term perspective.

Semiconductor manufacturers are therefore also examining very carefully whether and how much they invest in new fabs despite the boom in demand. Especially in a pandemic, this entails high risks. For although demand is high, machines for chips that are less in demand can stand idle. Infineon, for example, recorded vacancy costs of 600 million euros last financial year.

The same applies to chemical manufacturers who cannot increase their production capacities overnight. The situation is exacerbated by the fact that there is only a limited number of suppliers for chemicals in high-purity electronics or semiconductor grade quality. Moreover, many of the chemical suppliers do not only supply the semiconductor market, but a large number of customers in other industries. Just because chip demand is temporarily booming, these producers do not build a new plant.

So the obstacles to building new factories are high. Nevertheless, the automotive supplier Bosch has taken the plunge and opened a chip factory in Dresden in June 2021, primarily to secure its own demand. The company has invested around one billion in the AIoT factory.

Fig.: Semiconductor production at Bosch in Dresden: The illumination of the clean room consists of special yellow light that does not contain any UV rays. This prevents the photoresist-coated wafers from being exposed unintentionally. Photo: Bosch

After three years of preparation and construction, the new I

nfineon high-tech chip factory for power electronics on 300-millimetre thin wafers went into operation in Villach at the beginning of August. The chip factory is one of the most modern in the world and, as a "learning factory", focuses on full automation and digitalisation. In the first stage of expansion, the chips will primarily meet the demand of the automotive industry, data centres and renewable energy generation from solar and wind power. Over the next four to five years, production is to be gradually ramped up.

Fig.: An insight into the clean room of the new high-tech chip factory in Villach. Picture: Infineon

However, Infineon is going one step further by networking the Villach and Dresden sites. Both sites produce 300-millimetre thin wafers and are based on the same standardised manufacturing and digitisation concepts. This allows Infineon to control the manufacturing operations of the two sites as if they were one factory. Increased productivity and additional flexibility for customers are the unbeatable advantages of this virtual mega-factory.

Fig.: 1.6 billion euros were invested in the construction of the new Infineon High-Tech Chip Factory in Villach. Image: Infineon

Investment programme for Europe in the starting blocks

In order to strengthen Europe's position in semiconductor production, the construction of new chip factories, among other things, is to be promoted with 145 billion. The EU Commission wants to increase Europe's share of the world market from 10 percent to 20 percent in the coming years.

The US company Intel is already planning eight ultra-modern chip factories in Europe. About 30 per cent of the required investment of 80 billion euros is to be covered by public subsidies. In addition to Europe, the USA is also launching a 50 billion dollar programme to promote the domestic chip industry. State subsidies have also existed for years in countries like Taiwan, South Korea and especially China.

Semiconductor experts such as McKinsey, however, are clearly against investing billions in ultra-modern semiconductor plants in Europe. It would be a waste of money to build the most modern production processes in the EU. Instead, the EU should promote the production of those chips that are actually needed by European industry - and these are not high-end chips.

Intel's latest state-of-the-art manufacturing facility in Ocotillo, Arizona. Image: Intel Corporation

The bottom line: no quick improvement in sight

Unfortunately, it does not look at present as if the shortage of raw materials and chips will end in the foreseeable future. European manufacturers who rely on supplies of high-quality raw materials and semiconductors from overseas are therefore advised to increase the robustness of their supply chains. One possible option is higher diversification and increased regionalisation of the supply chain in terms of chemical and semiconductor suppliers. Similarly, a reassessment of whether stockpiling critical raw materials and inputs is preferable to the just-in-time business model may be useful.

www.donauchem.at

Weiterführende Links/Quellen:

Falter 37/21 vom 15.09.2021 - Kein Chip wird kommen

www.donauchem.at

Weiterführende Links/Quellen:

Falter 37/21 vom 15.09.2021 - Kein Chip wird kommen